LHV Pensionifond L

Suitable if

- you have average risk tolerance,

- your aim is the long-term growth of your pension savings.

Crisis-resilient flagship L

- The L fund strategy is based on the principle that a prerequisite for a proper rate of return is the ability to avoid major losses. That is why we diversify this fund’s investments across several asset classes. As the proportion of equity is moderate, the fund is less exposed to stock market movements.

- Real estate as an asset class accounts for just over 20% of the fund’s investments, providing a secure and stable cash flow in an inflationary environment. We evaluate real estate properties once per year.

- L is actively managed, which is why the risks are managed and the pension saver’s money is kept safe. Our investment team makes decisions based on thorough analysis and the economic situation.

Kristo Oidermaa

Fund Manager at LHV

„If the portfolio is diversified in terms of the money it invests, it is also possible to come out of crises with very few losses. Pension fund L has had a positive rate of return for 12 years in a row, already.“

Biggest investments

The data is presented as at 30.11.2024

| Biggest investments | |

|---|---|

| ZKB Gold ETF | 3.69% |

| Investindustrial VII L.P. | 3.31% |

| iShares Gold Producers UCITS ETF | 3.15% |

| France Treasury Bill 25/02/2025 | 2.92% |

| German Treasury Bill 11/12/2024 | 2.87% |

| AMUNDI EURO STOXX BANKS UCITS ETF | 2.80% |

| EfTEN Real Estate Fund | 2.70% |

| Partners Group Direct Equity 2019 | 2.42% |

| East Capital Baltic Property Fund III | 2.29% |

| Usaldusfond BaltCap Private Equity Fund III | 2.12% |

Biggest investments in Estonia

| Biggest investments in Estonia | |

|---|---|

| East Capital Baltic Property Fund III | 2.29% |

| Usaldusfond BaltCap Private Equity Fund III | 2.12% |

| East Capital Real Estate Fund IV | 1.70% |

Asset Classes

Information about the fund

| Information about the fund | |

|---|---|

| Volume of the fund (as of 30.11.2024) | 851,607,923 € |

| Management company | LHV Varahaldus |

| Equity in the fund | 1,600,000 units |

| Rate of the depository’s charge | 0.0403% (paid by LHV) |

| Depository | AS SEB Pank |

Entry fee: 0%

Exit fee: 0%

Management fee: 0,6120%

Success fee: Performance fee is 20% of the positive difference between the fund's performance and the benchmark, maximum of 2% per annum of the fund's volume. Performance fee for 2021 0,24%.

Ongoing charges (inc management fee): 1.56%

The ongoing charges figure is an estimate based on the current management fee and the 2023 level of all other recognized costs. Ongoing charges may vary from year to year.

Terms and Conditions

Prospectus

November 2024: We increased the volume of our direct investment portfolio

Kristo Oidermaa and Romet Enok, Fund Managers

Donald Trump’s election victory spurred a strong rally in US indices, with the S&P 500 ending November up 5.7% in dollar terms. Meanwhile, the Euro Stoxx 50 index declined by 0.4% in euro terms during the month. The emerging market index fell by 3.7% in dollar terms, largely driven by a 4.4% drop in China. The OMX Baltic Benchmark index also fell by 3% over the month.

During the month, we increased our position in Fortum. In November, our energy-related positions made the most positive contribution to returns, rising by 5% to 27%. On the other hand, the most negative impacts came from one of our gold positions, which fell by approximately 9%, the European banks index, which declined by around 3.2%, and our energy metals position, which dropped by approximately 6.3%. We continue to see good opportunities in the commodity sector, given the protection it provides in a challenging geopolitical environment, as well as in Scandinavian companies due to their high quality and strong competitiveness. We have also increased our exposure to US stocks in recent months and intend to increase this exposure in the future.

In November, EfTEN Real Estate Fund 5, in partnership with six Estonian entrepreneurs, announced the acquisition of Tallinn’s Kristiine shopping centre, valued at €123.5 million. This marks the fund’s final investment. The centre spans 61,600 sq. m and houses 120 tenants, with the largest being Prisma and Apollo. The acquisition is financed through a combination of equity and a syndicated loan from SEB and Swedbank.

Last month, we expanded our direct investment portfolio by entering into a loan agreement with Eastnine, a real estate company primarily focused on the Lithuanian and Polish markets. The loan has a three-year term, and the pension fund earns an annual interest rate of 8.5%. At the same time, Eastnine also raised new equity and secured bank loans, continuing its growth plans in the Polish commercial real estate market. Having previously held investments in Estonia, the company has now set its sights mainly on the Polish market, where assets now make up the majority of its portfolio following this major transaction.

October 2024: Gold drives positive returns in the stock portfolio

Kristo Oidermaa and Romet Enok, Fund Managers

The US S&P 500 index ended October with a return of −1% in dollar terms, while the European Euro Stoxx 50 index posted −3.3% in euro terms. The emerging markets index declined by 4.4% in dollar terms over the month, driven primarily by China, where the index fell by 6% in dollars. The wave of optimism that emerged in China in September has somewhat diminished. Meanwhile, the OMX Baltic Benchmark index rose by 3.5% over the month.

In October, we added the Finnish energy company Fortum to our funds, reduced our gold holdings and sold off the Finnish retail company Kesko from L and Active III. The top performers in the stock portfolio were our gold-related positions, which gained between 4.5% and 7.5%, and our European banking index fund, which increased by 3.5% in October. On the downside, our investments in energy metals dropped by 7% to 9% and our Chinese position in Alibaba declined by around 12%.

We continue to see good opportunities in the commodity sector, given the protection it provides in a challenging geopolitical environment, as well as in Scandinavian companies due to their high quality and strong competitiveness. We have also increased our exposure to US stocks in recent months and intend to increase this exposure in the future.

October was a particularly active month for the EfTEN Real Estate Fund, which acquired a logistics centre and signed a contract to purchase a production and storage facility. The logistics centre in Tallinn has ELP Logistics OÜ as the anchor tenant, with a lease commitment extending for at least ten years. The production and storage facility under development in Harku municipality is being built for ICONFIT, the Baltic region’s leading producer of sports, diet and health foods. ICONFIT has also signed a long-term lease agreement with the fund, with a term of ten years.

In the bond portfolio, we realised gains on yet another major position. After selling Volkswagen bonds following their price increase in the summer and receiving a loan repayment from Sunly in September, we have now sold our long-term investment in Riigi Kinnisvara AS bonds. Bond prices on the exchanges have risen considerably, so when considering new investments, we are again looking towards direct investments. We anticipate that the next likely transaction in the portfolio will be the acquisition of a new position in an over-the-counter investment.

September 2024: The largest indices ended the month positively

Kristo Oidermaa and Romet Enok, Fund Managers

The beginning of September was quite volatile, just as the beginning of August was; nonetheless, the major indices ended the month positively. The US S&P 500 index was up 2% in dollars and the European Euro Stoxx 50 rose 0.9% in euros. The emerging markets index was up as much as 6.4% in dollars during September. This was mainly due to China, whose index gained 23.5% in dollars as the market responded to the country’s long-awaited major government spending aimed at stimulating the economy. The Baltic OMX Baltic Benchmark index saw little change, ending the month down 0.8%.

After a six-year investment, the Livonia fund sold its stake in the Lithuanian company Freor to the company’s management. Freor manufactures top-quality refrigeration equipment to help food retailers reduce environmental impact and energy consumption. The company was founded in 2000 and, since then, it has managed to expand operations to 55 countries.

In September, we sold six investments from the stock portfolio: Siemens Healthineers, Roche Holding, GN Store Nord, Huhtamäki, Valmet and Agnico Eagle Mines. The fund did not make any new purchases.

During the month, our energy metal positions, physical gold and Alibaba delivered the best results, reflecting more positive sentiments in the market due to the announcement that the Chinese government would increase its support to its economy. Investments in the energy sector and gold mining enterprise Barrick Gold Corp. were the biggest drags on the fund’s results in September. We still see good opportunities in the commodity sector thanks to the protection the sector offers to the investor in a difficult geopolitical environment, as well as in Nordic companies thanks to their guaranteed quality and competitiveness.

One of the more significant direct investments in the fund’s bond portfolio came to an end when Sunly repaid its bonds. Sunly raised 13 million euros from LHV funds for renewable energy investments in 2020. In the time since, Sunly has grown so fast that its equity went up from 13 million euros four years ago to nearly 300 million euros by the end of 2023. Our bond investment yielded around 9% per annum during this period.

We continue to look for new local projects where LHV pension funds can participate in similar developmental leaps.

August 2024: Gold-related positions gained 4%–8% in August

Kristo Oidermaa and Romet Enok, Fund Managers

August was quite volatile for the markets. After falling earlier in the month, the S&P 500 index recovered to end the month up 2.3% in dollars. The European Euro Stoxx 50 ended August up 1.8% in euros. The emerging market index rose 1.4% in dollars during the month, with China, the biggest contributor to that rise, up 1%. The OMX Baltic Benchmark index fell by approximately 2.7% in euros during the month.

The biggest contributors to the fund’s equity portfolio last month were gold positions, which rose 4%–8%, and the European banks index, which rose 3.4%. The poorest performers were investments related to energy and silver, which fell by 15%–20% and 11%, respectively.

In August, LHV pension funds sold a stake in the forest fund Birdeye Timber Fund 1 for 8.4 million euros. The duration of the investment was ten years, during which period we contributed to the development of Estonian forests and the management of the forest portfolio. Forest land as an asset class is based on real property and is less volatile than traditional investments such as stocks and bonds.

Due to structural undersupply and the protection it offers in an uncertain geopolitical environment, we continue to see good opportunities in the commodity sector.

July 2024: Precious metals provided a positive contribution

Kristo Oidermaa and Romet Enok, Fund Managers

July was a rather volatile month on the stock markets. While the S&P 500 index, which largely represents technology stocks, dipped during the month and ended with a 1.1% return in dollar terms, the Dow Jones index, which reflects more established industrial-sector companies, performed much better, with a monthly return of 4.4%.

The Euro Stoxx 50 index saw little change in July, with its value decreasing by 0.3% in euro terms. The emerging markets index also remained largely unchanged. The index was negatively impacted by China, which declined by 2.2% in dollar terms, but positively influenced by India and Indonesia, which rose by 3.9% and 3.5%, respectively. The OMX Baltic Benchmark index increased by approximately 1% in euro terms over the month.

In July, the largest private-equity fund in the Baltics, BaltCap, announced that it had acquired the business software platforms FitekIN and ONEA from the Belgian technology firm Unifiedpost Group. FitekIN has previously been owned by BaltCap, so the fund is already well-acquainted with the company. FitekIN and ONEA provide businesses with automation and digitisation solutions for invoice management and approval. Both platforms operate in 13 countries across Europe, with plans to expand into additional markets in the future.

We didn’t execute any major transactions in the stock portfolio during the month. The positions related to precious metals contributed the most to our returns, appreciating by 2.5% to 18%. In contrast, our investments in metals used in energy production and storage had the most negative impact on July’s returns, declining by 4% to 6%. Additionally, one of our positions in the timber industry lost approximately 10% of its value due to quarterly results that fell short of investor expectations.

Thanks to structural undersupply and the resilience that the commodities sector offers in the current uncertain geopolitical environment, we continue to see strong opportunities in this sector.

In the bond portfolio, we locked in profits in several ways during July. First, the commercial real estate fund Baltic Horizon made its final planned early redemption payment, and then Bigbank fully repaid its subordinated bond from 2017. Additionally, we sold our entire position in Volkswagen’s subordinated bonds from 2023.

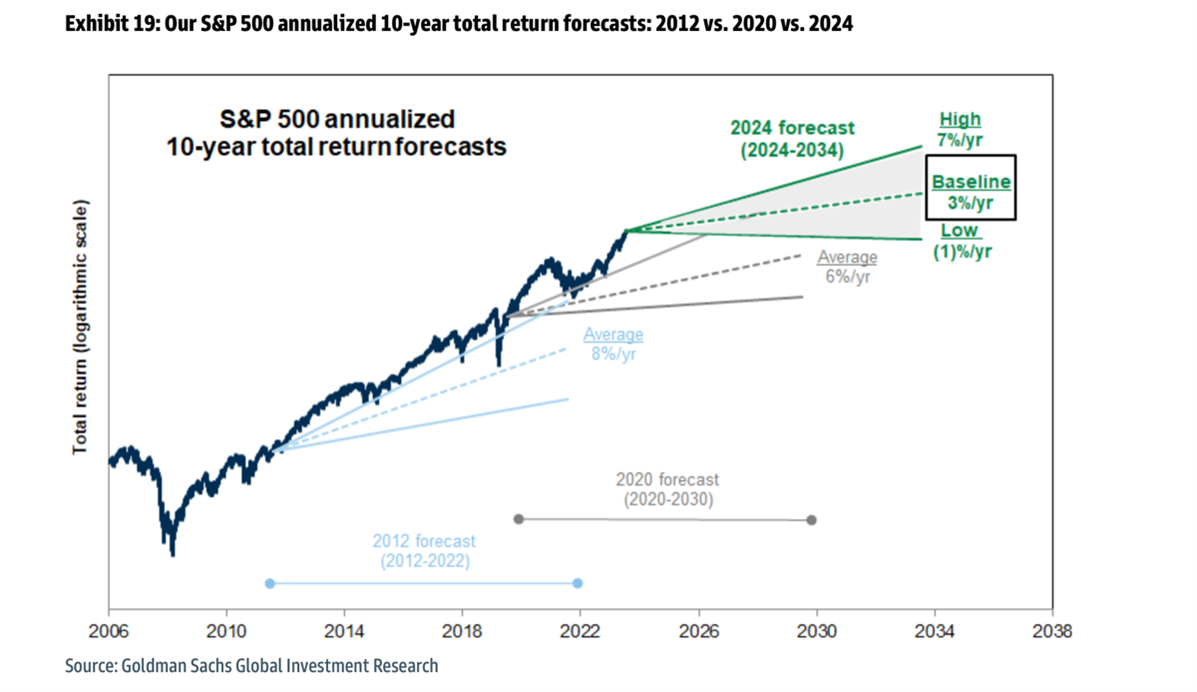

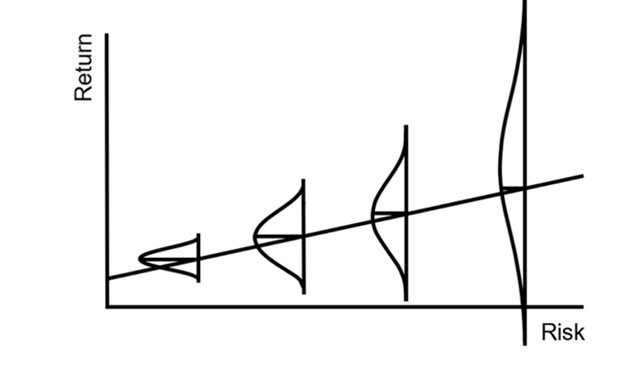

Is maximum risk the optimal strategy?

Andres Viisemann, Head of LHV Pension Funds

October was a relatively calm month in the securities markets. On 17 October, the European Central Bank lowered its short-term interest rates by 0.25 percentage points. Since the decision was widely anticipated and already priced into stock markets, it elicited little reaction from participants.