Open the LHV mobile app and navigate to the "Investment" screen (third icon from left at the bottom).

Through LHV, you can now invest directly in crypto assets

Crypto assets are a digital form of money, which has proven to be a popular complement to “real” money. Crypto assets can be used on different platforms to pay for services or simply as a store of value in the given crypto instrument.

Platforms based on crypto assets are generally structured without a central owner – they remain stable due to their decentralized customer base. For now, crypto assets acquired by clients by LHV cannot be used on platforms to pay for services or make transfers. The best known decentralized crypto asset is currently Bitcoin.

- Customers can hold crypto assets at LHV free of charge. A 0.5% service fee applies to buy and sell.

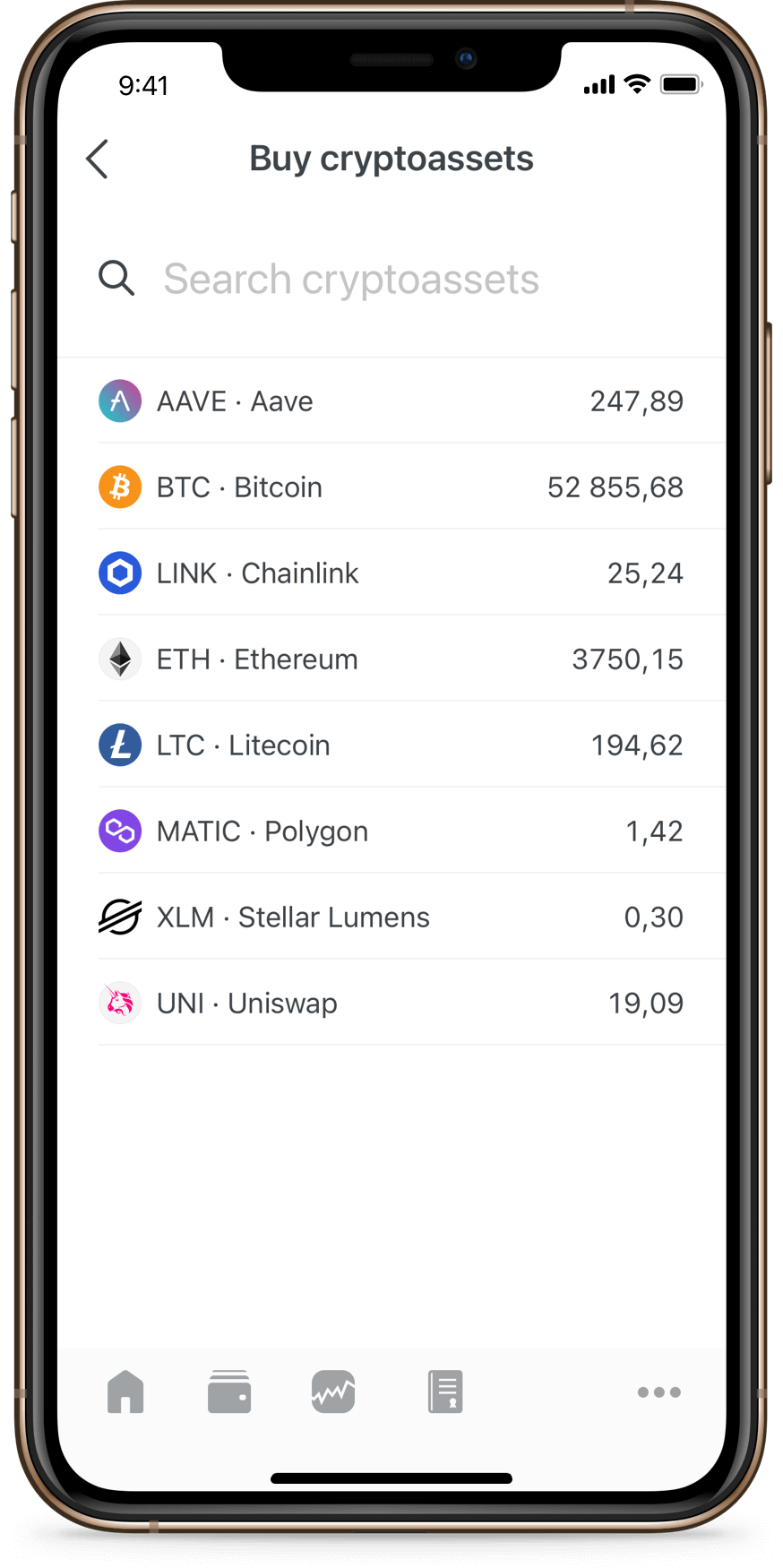

- Access to thirteen popular crypto assets

- You can buy crypto assets both as an individual and as a company. Note that different tax rules apply in each case.

- Crypto assets are a high-risk financial instrument, so if you are trading these assets, be aware of the risks.

LHV makes investing easy and convenient.

Access to the most popular crypto assets

Buy popular crypto assets from LHV. We support many different crypto assets, including Bitcoin and Ethereum.

Convenient transactions

You can purchase LHV-supported crypto assets in the "Investing" section of the mobile app. Select "Purchase crypto assets" there and enter the desired asset and the amount. In the Internet bank you can buy crypto assets by going to "Investing", and clicking on "Crypto assets buy/sell"

24/7 transactions

You can trade crypto assets any time and day of the week. Transactions are executed immediately.

Low transaction fees

Buying and selling small amounts of crypto assets is cost-effective. While transaction fees on larger platforms can be up to 10% of the transaction amount, LHV's transaction fee is 0.5% regardless of the amount.

See the price list.

Fractional buying and selling

You can also buy crypto assets in fractions of units. The minimum buy order is 20 euros and minimum sell order is 10 euros.

Send tax information easily

For individual investors who have acquired crypto assets, income tax returns are easy, because we display your capital gains by each instrument. You no longer have to report each transaction to the tax office separately. Instead, you can declare your gains for each instrument.

Read more about taxation of crypto transactions.

Crypto assets

How do I buy crypto assets?

Taxation

Private person

If you're trading crypto assets as an individual, bear in mind that any transaction that nets gains should be reported to the tax authorities and is subject to income tax. Note: Gains are not offset by losses. So, for example, if you have a capital gain of €20 from selling Bitcoin and make a loss of €30 later on, you still have to pay income tax on the €20 gain.

We have made it as easy as possible to declare the income from crypto assets to the tax authority. When it comes time to file you taxes, you will receive a summary of your crypto asset transactions via LHV internet bank, which you can submit to the Tax Board more easily: by each instrument. As an individual, you won't have to report each transaction to the tax office separately, but you can submit the summary to the tax office, prepared by us for each instrument.

Read about the taxation of crypto assets for private persons.

Legal person

We've made it easy for business clients to buy crypto assets: you don't have to spend time opening an account with another crypto trading site. A company also does not need an LEI code (link) to buy crypto assets. If you have a corporate account with LHV, you can also buy crypto assets there. Gains from crypto assets are taxed in the same way as any other corporate income: the tax liability only arises if the company pays dividends, salaries or fringe benefits.

Price list

| Maximum order amount | 100,000 € |

| Transaction fee (buy-sell) | 0,5% |

| Management fee | Free |

| Minimum buy order | 20 € |

| Minimum sell order | 10 € |