LHV home loan

The most flexible home loan in Estonia, which is suitable for an informed client acquiring a home. Build yourself a new home or renovate a property that you already own.

- Initial loan offer within 24 hours

- Premature repayment of the loan is free of charge

- New apartment valuation report at an affordable price

- Interest from 1.49% + 6-month Euribor for buying a new energy class A or B home.

Home buying planner

How far are you on your journey to becoming a home owner?

Calculate the monthly payment

This is an estimate and may differ from the actual terms and conditions offered.

This is an estimate and may differ from the actual terms and conditions offered.

Down payment for home loan

Investing with LHV Growth Account may allow you to reach the necessary down payment amount faster.

See more

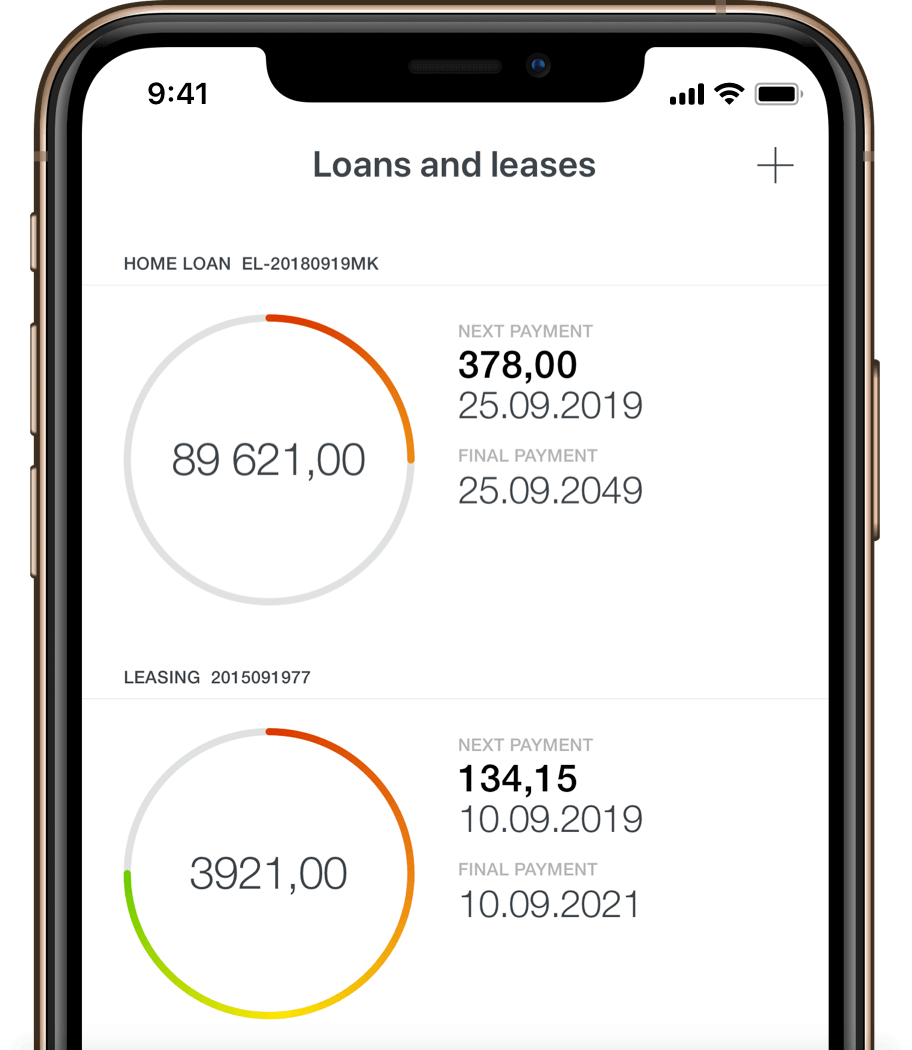

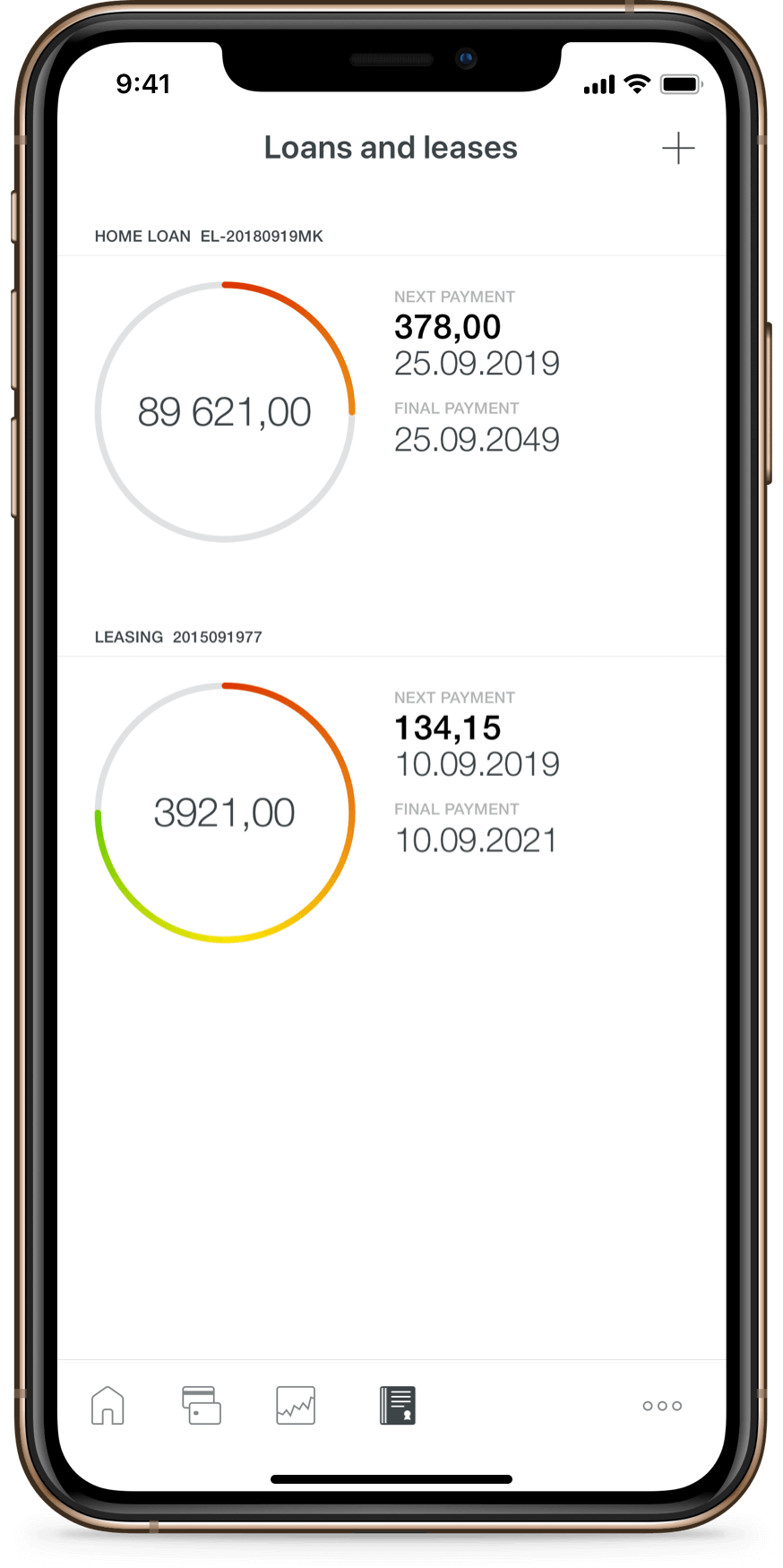

Already have a home loan?

If you have already taken a home loan from LHV or another bank, and want to purchase another property with a loan, then apply for an LHV private Loan.

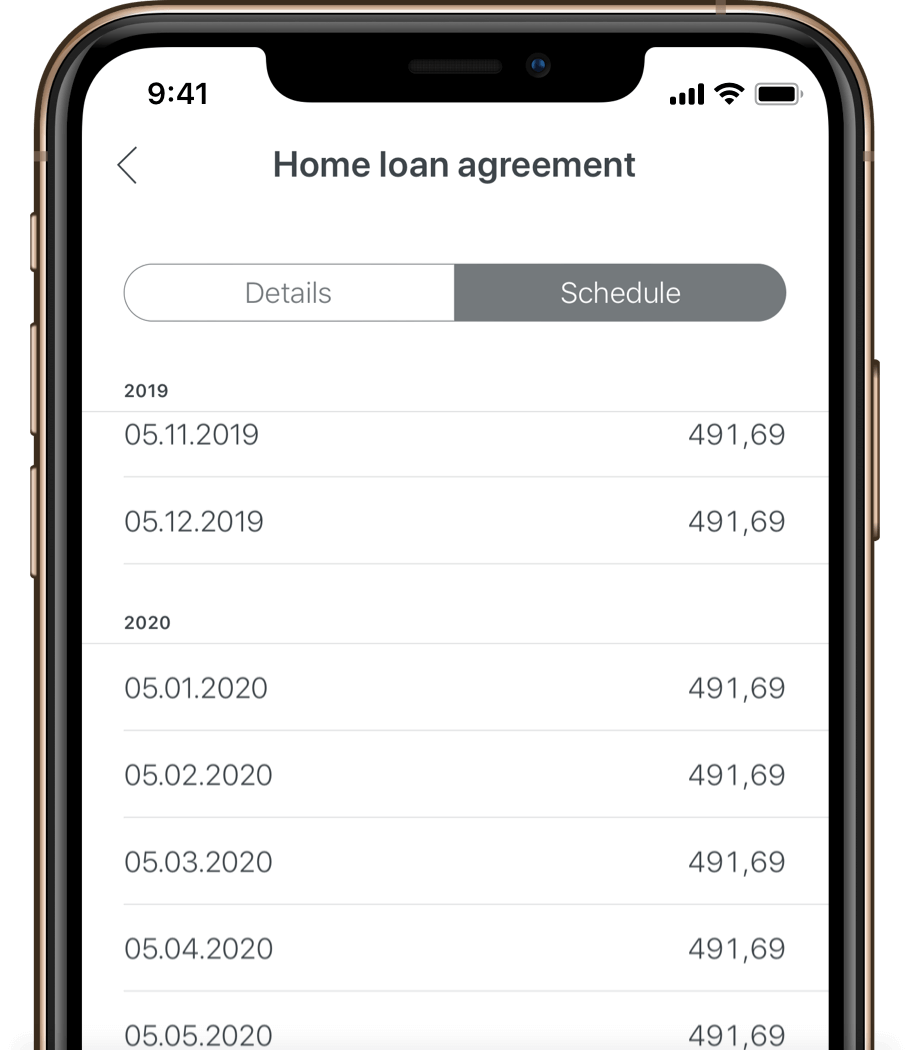

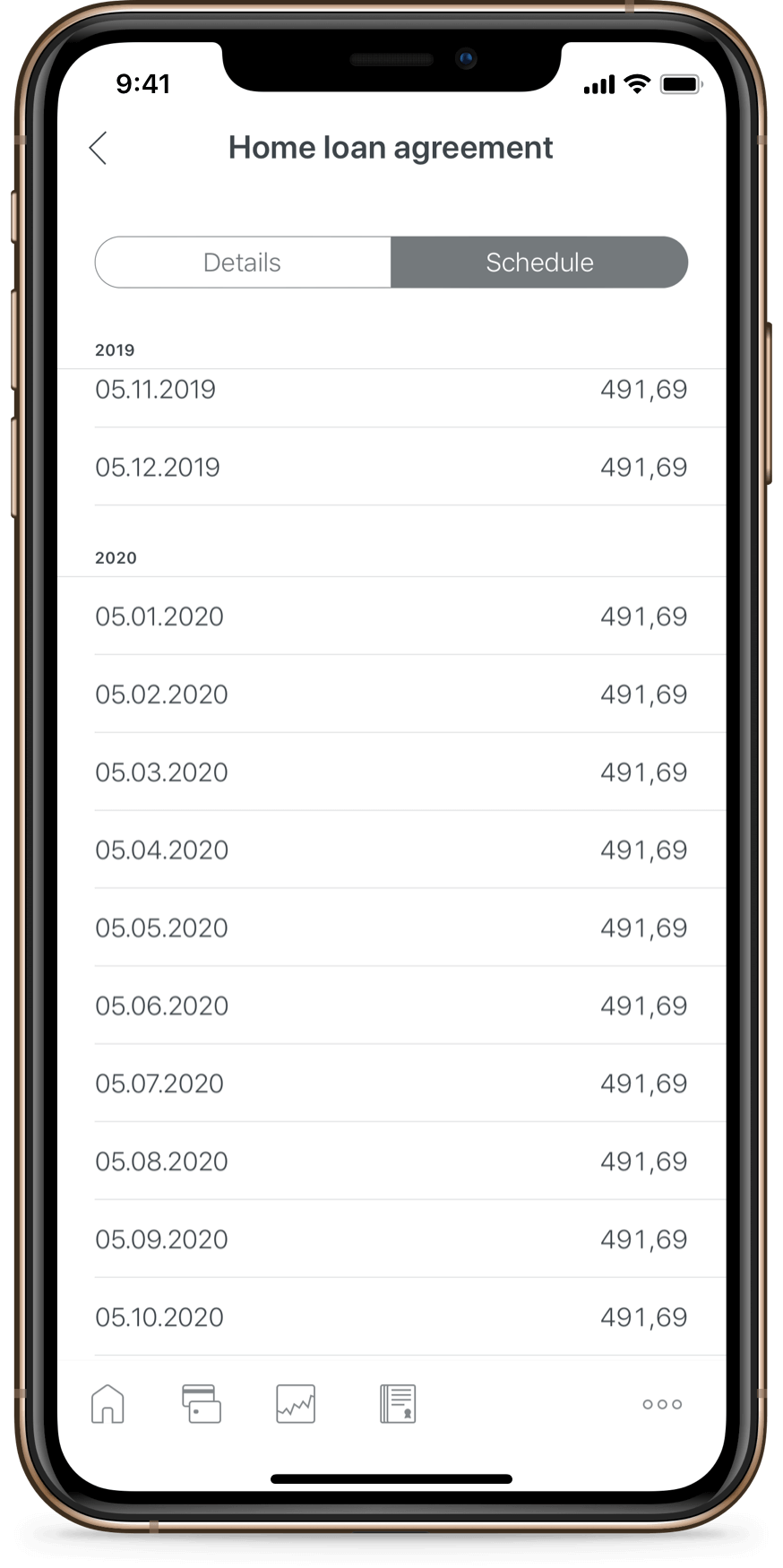

Home loan or private loan contract amendment

If you would like to make changes to your contract, please submit us an application that you can find from the loan contract information section in your internet bank.

KredEx surety

Are you a specialist in your field, up to 35 years old, a parent of at least one child or looking to buy an energy-efficient home? We can offer you a home loan with lower self-financing (min. 10%) with a KredEx surety. Read more about the exact terms and conditions on their website.

We seek to promote the construction and buying of energy efficient homes by offering better loan terms for energy class A and B homes. We support decisions that lead to lower climate impacts and increased savings on power bills.

Interest rates starting from 1.49% + 6-month Euribor on purchases of energy class A and B homes

Application process

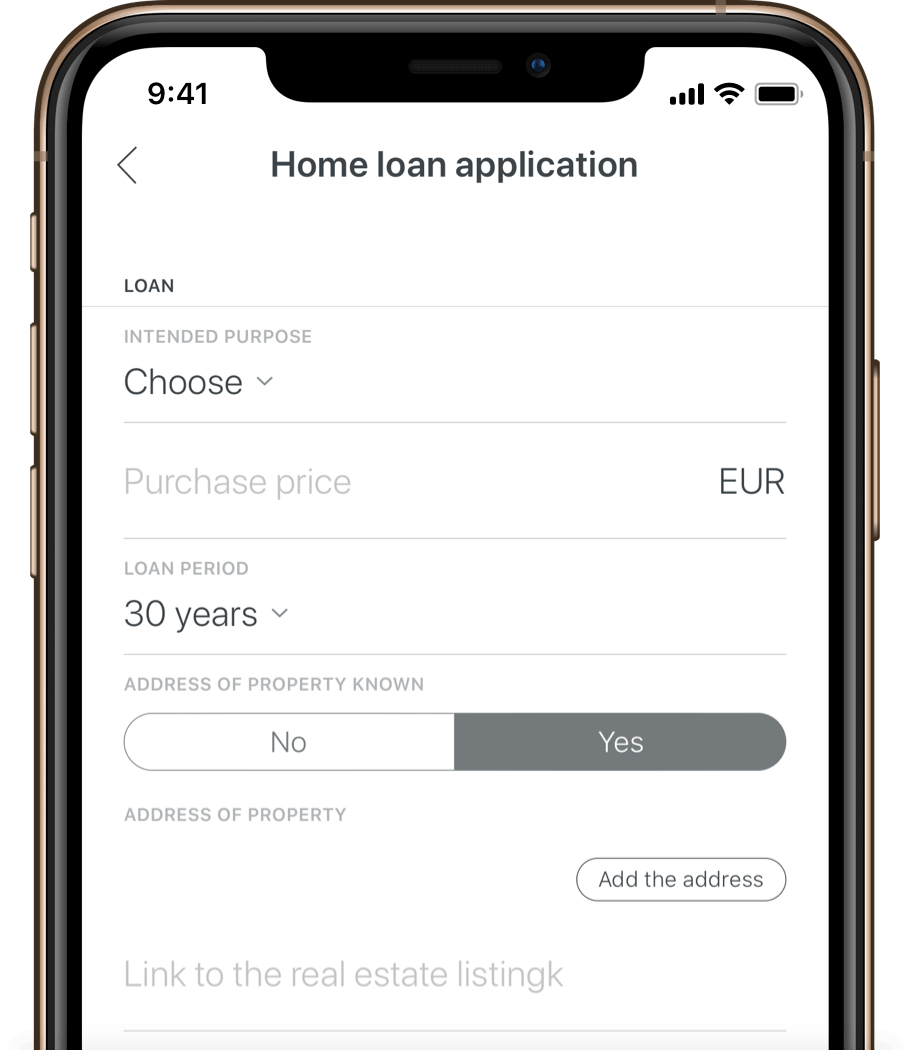

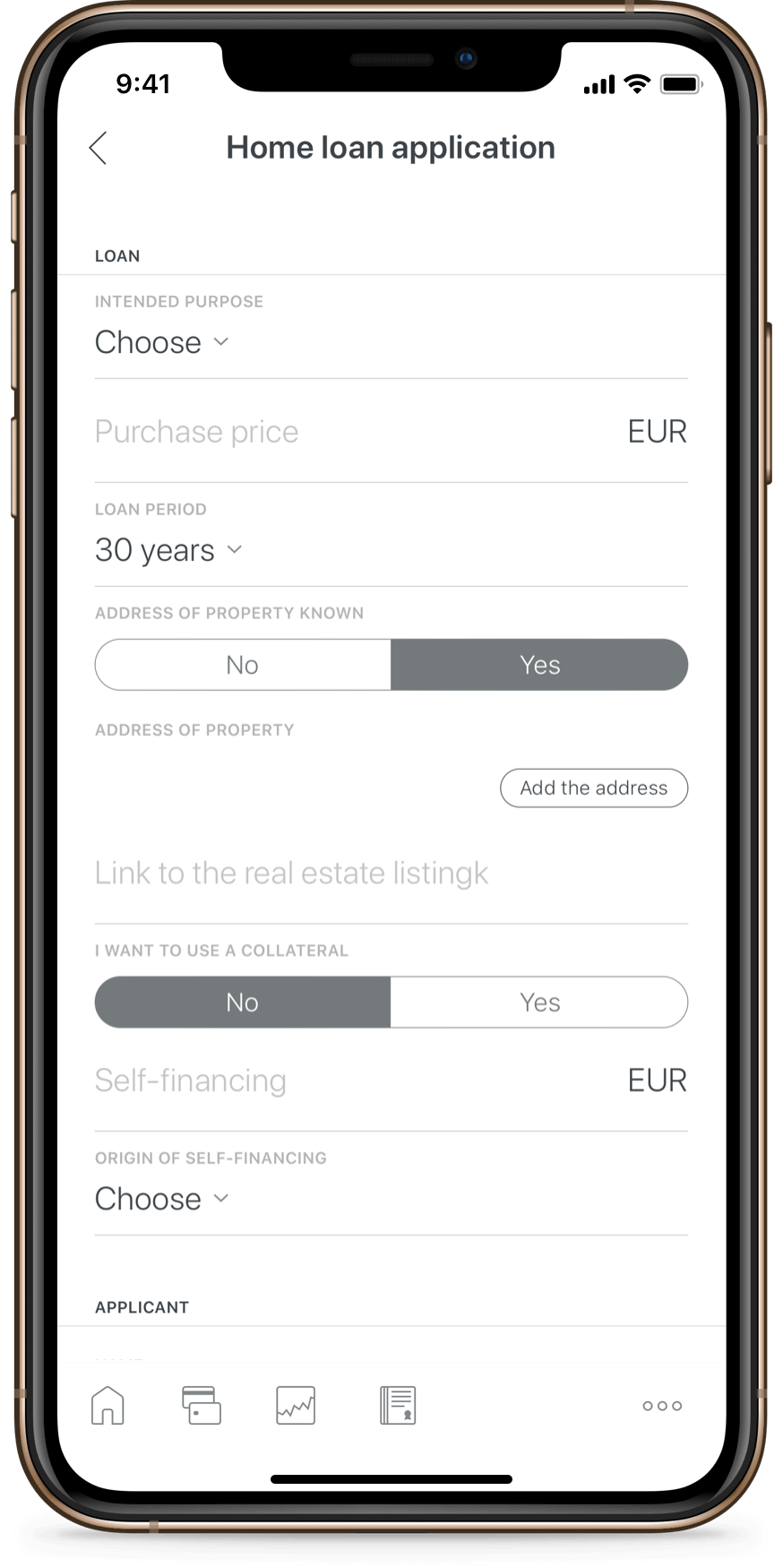

Application

Fill in a home loan application.Initial loan offer

You will be notified of your initial loan offer within 24 hours.Documents

Send the documents requested in the initial offer to kodulaen@lhv.ee.Loan decision and agreement

The final offer and loan agreement will be emailed to you. Sign the contract digitally and send it back to LHV.Notary

We will book an appointment at a notary, at a time that suits all the parties, to set the mortgage.Payment

We will transfer the loan to your account within one working day after visiting the notary.

Terms and conditions and price list

| Loan amount | From 20,000 €, up to 85% of the market value of the collateral. In the case of the KredEx surety, up to 90% of the market value of the collateral. The total sum of all loan and leasing payments may be up to 50% of the net income. The actual maximum share of loan payments depends on the income and number of members in the family. |

| Loan period | Up to 30 years |

| Interest | The interest rate consists of an individual margin and 6-month Euribor rate |

| Amendment of the agreement | starting from 100 € |

| Termination of agreement | Free of charge |

| Agreement fee | 0.5–0.9% of the loan amount (minimum 300 €) In the case of the KredEx surety, you need to pay an additional suretyship fee of 3% of the surety amount upon conclusion of the agreement. |

| Grace period | Up to 12 months. You may extend your parental leave up to 12 months during a period of up to three years after the birth of the child. |

| Self-financing | At least 15% or with an additional collateral. In the case of the KredEx surety, at least 10%. The exact amount required as self-financing depends on the property being purchased. |

| Collateral | Real estate that is in good condition and liquid. In general, we accept assets belonging to the loan recipient or their loved ones as security. We do not accept the only real estate owned by parents and used as their place of residence as additional collateral. We finance up to 85% of the market value of collateral. The precise acceptance rate of collateral depends on the location and condition of the collateral. Notarial transactions can be performed in Tallinn, Tartu, Pärnu, Rakvere, Narva, Viljandi, Paide and Kuressaare. |

| Requirements for an applicant |

|

| Required documents | Send to the address kodulaen@lhv.ee:

If you belong to the young family target group:

For further information, see the KredEx website. |

| Apartment valuation | We offer apartment valuations by LHV at an affordable price – 150 € |

| Real estate appraisers | 1Partner Kinnisvara, Arco Vara, Colliers International Advisors, Domus Kinnisvara, Kaanon Kinnisvara, Eri Kinnisvara, LVM Kinnisvara, Ober Haus, Pindi Kinnisvara, Tõnisson Kinnisvara, UusMaa Kinnisvarabüroo, RE Kinnisvara, Seven Kinnisvarakonsultandid, Lahe Kinnisvara, Kinnisvaraekspert, Aarete KV OÜ, Newsec Valuations EE OÜ |

| Financing construction of the house |

|

| Required documents |

|

AS LHV Pank does not provide counselling service in the sense of Section 7 of the Creditors and Credit Intermediaries Act in the provision of loans. The loan applicant makes the decision to take out a loan.

The home loan is offered by AS LHV Pank. Always think through your loan decision carefully. Review the terms and conditions at lhv.ee/kodulaen and ask for advice from our specialist. The annual percentage rate of charge for a home loan is 4,444% on the following sample conditions: loan amount of 140,000 €; interest rate of 4.34% per year (floating, the interest rate consists of 6-month Euribor rate and margin 1.6%); agreement fee of 300 €; period of 360 months; 360 as the number of repayments; and the total amount paid back being 250,697.87 €, with payment in the form of monthly annuity payments. An insurance contract needs to be concluded and a mortgage set for the collateral in order to receive the loan. The rate does not include the expenses related to establishing and insuring the collateral.

Documents and additional information

If you belong to the large family target group

- A loan can be applied for with only a 5% minimum self-financing requirement. Families where parents or a single parent are raising at least three children up to and including the age of 19 are eligible for a loan at this minimum self-financing level.

- The KredEx fee is 2% of the guaranteed amount. KredEx offers the bank a guarantee up to 50,000 euros and 40% of the loan.

LHV Home Insurance

Insurance with the widest protection gives you peace of mind and a sense of security in your new home. LHV home insurance protects your home and items that are in your home or with you anywhere in the world on a total risk basis.

Customer support

Call 699 9118 Mon-Fri 9-17 or write to kodulaen@lhv.ee