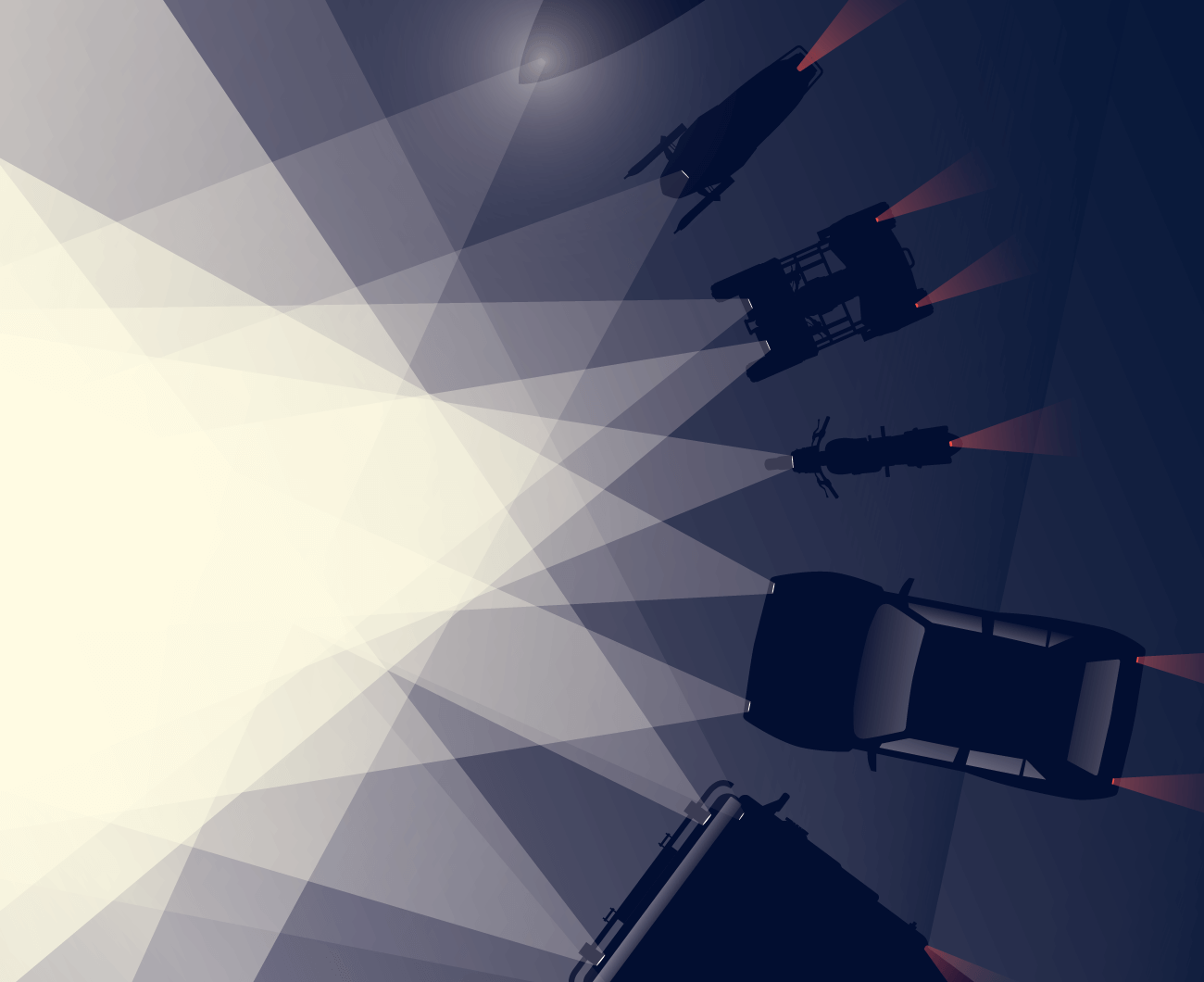

With a Car Loan, motor own damage insurance or down payment is not obligatory for you

Get the kind of vehicle you need: from a car to a motorboat. You can also use the loan for the repair of your vehicle. You can apply even before selecting a specific vehicle and it does not oblige you to enter into a contract.

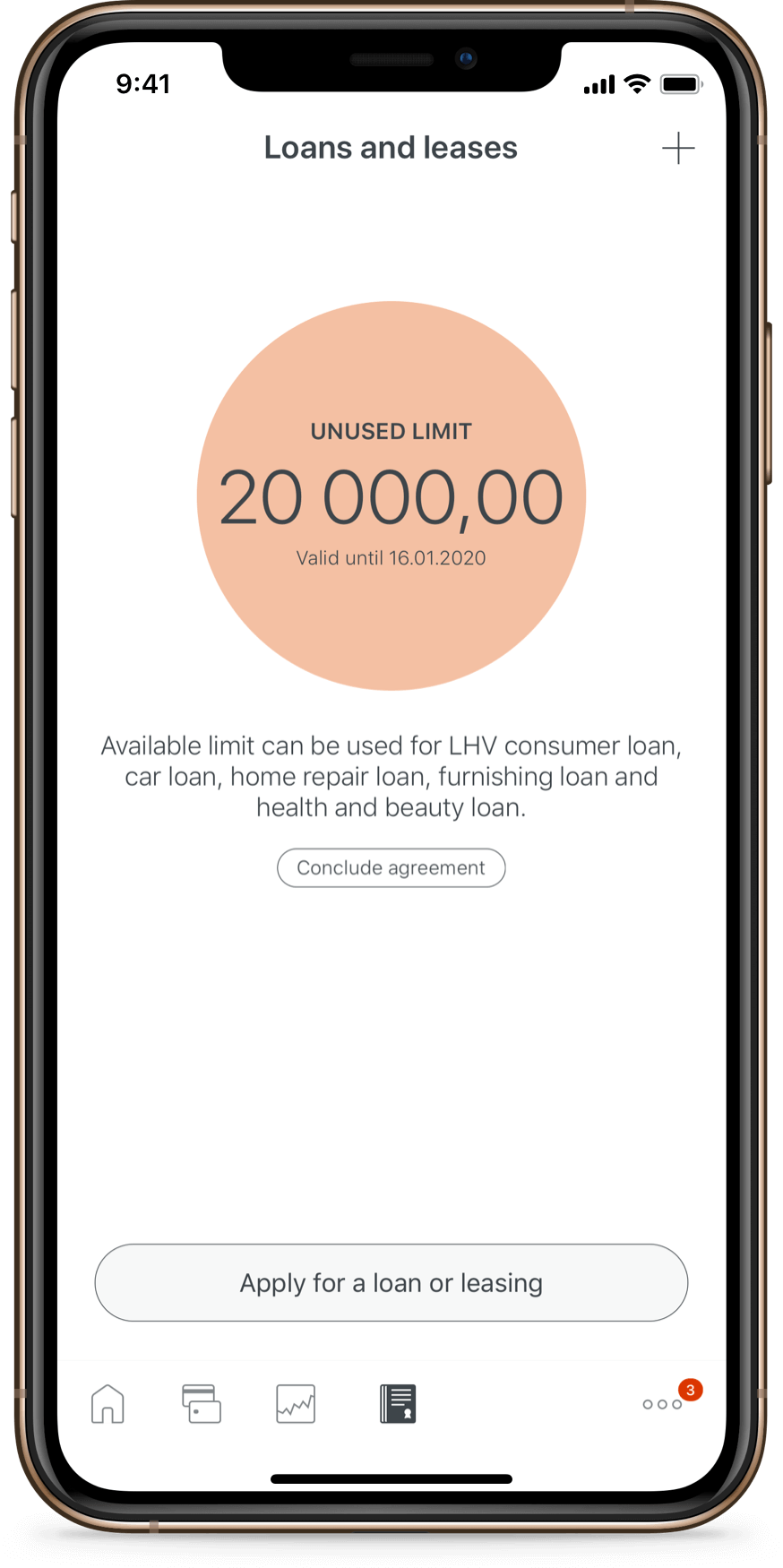

- You will receive a response to your application within a few minutes

- No collateral required

- Money to your account immediately

- Loan sum up to 25,000 €

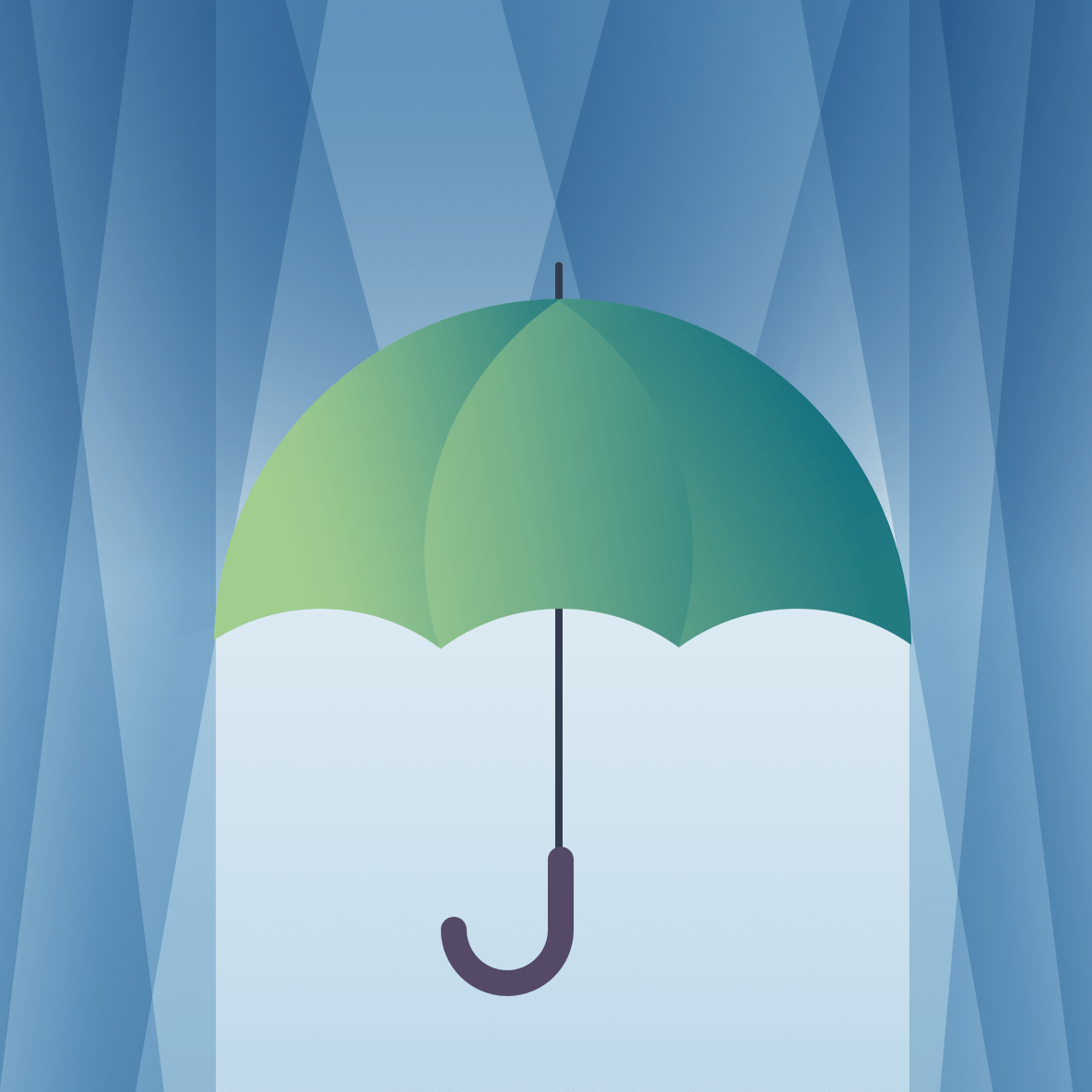

- Loan insurance options

- Free premature repayment

You do not need to have an account with LHV to apply for a car loan.

Choose the solution that is right for you

Car loan

Leasing

Loan amount

Up to €25,000

From €5,000

Interest

Personal interest starting from 7.9%

Personal interest margin + 6-month Euribor

Contract fee

2% of the loan amount, at least €29.90

1% of the price of the property, at least €150

Length of the Contract

6 months to 10 years*

6 months to 7 years

Down-payment

Not obligatory

At least 10% of the price of the property

Age limit for the property

None

Up to 12 years by the end of the leasing period

Car owner

You yourself

Lessor

Casco insurance

Voluntary

Obligatory

Calculate the monthly instalment

The results are estimated and may differ from the terms and conditions offered to you.

Fill in application

Fill in car loan application. There is no charge for submitting an application, and doing so does not obligate you to conclude an agreement. If a statement of account must also be submitted, we will inform you of this separately.Offer

Once we receive your application, we will make you a loan offer that is valid for up to 180 days.Conclude agreement

You can sign the agreement in self-service environment. If you cannot sign it digitally, please visit our partner Euronics store. There, you can sign a printed contract.Money to your account

Within a few minutes, the loan amount minus the agreement fee will arrive in your bank account.

| Loan sum | Up to 25,000 € |

| Interest | Annual interest from 7.9% on loan balance. LHV calculates the interest on the outstanding loan balance, not the whole loan sum. This means that interest payments decrease each month, as your loan balance decreases. |

| Contract fee | 2% of loan sum, at least 29.90 € |

| Service fee | 2.99 € per month |

| Length of the agreement | Credit amount up to 7,500 € – 6 months to 6 years |

| Amendment of agreement | The fee for amending the agreement is 25€. To amend the agreement, please write to finance@lhv.ee. |

| Early repayment | Early repayment of the entire credit sum is free of charge. |

| Repayment | Monthly payments are to be paid to the account EE707700771001062897; beneficiary: LHV Finance: reference number: your agreement number. |

| Confirmation submission | Please send a copy or a photo of your vehicle’s registration certificate to finance@lhv.ee after the conclusion of the Car Loan contract. |

The Car Loan is offered by AS LHV Finance. Take a look at the terms and conditions at lhv.ee/en/car-loan and consult a specialist. Annual rate of charge is 15.5% on the following sample terms and conditions: loan amount 7,000 €, annual interest rate of 12.9% on the on the outstanding balance (fixed), contract fee 140 €, monthly service fee 2.99 €, repayment period of 70 months, with monthly annuity payments, with the total sum of the monthly payments being 10,346.00 € and the total repaid sum of 10,206.00 €.

Loan insurance is offered by AS LHV Insurance. Review the terms and conditions of insurance, along with the limitations and exemptions, and ask for advice from our specialist. The the annual percentage rate of charge of Consumer Loan with insurance is 18.97% on the following sample terms and conditions: loan amount 7,000 €, annual interest rate of 12.9% on the on the outstanding balance (fixed), contract fee 140 €, monthly service fee 2.99 €, repayment period of 70 months, with monthly annuity payments, with the total sum of the monthly payments being 11,140.00 € and the total repaid sum of 11,000.00 €.

Documents and additional information

- Precontractual information

- Price list for the car loan

- General terms and conditions of the car loan

- Loan Insurance Terms and Conditions

- Loan Insurance Terms and Conditions (Effective until September 30, 2023)

- Loan Insurance Terms and Conditions (Effective until August 31, 2022)

- Loan Insurance Terms and Conditions (Effective until March 31, 2021)

- Loan Insurance Terms and Conditions (Effective until May 20, 2020)

- Application for the amendment of an agreement

- Application for the withdrawal from an agreement

Frequently asked questions

- Who can apply for a loan?

- In which case and how do I have to present my bank statement?

- How can I conclude the loan agreement?

- I want my monthly payment to be debited from my bank account automatically. What do I need to do for this?

- Can I increase or decrease my monthly payment?

Loan insurance

You can make your loan more secure by adding insurance to your contract. Loan insurance ensures that you will not find yourself in trouble with loan instalments in the event of unforeseen circumstances. Read the terms and conditions of loan insurance.

- becoming unemployed for reasons beyond the insured person’s control;

- temporary incapacity for work, i.e., a certificate of incapacity for work valid for over 30 days;

- absence of work capacity, i.e. the borrower has been issued a work capacity assessment decision;

- death, i.e., any loan liability does not have to be met by your successors.

In case of an insured event, notify client support at LHV Finance as soon as possible. Client support will notify the loss adjuster, who will contact you with further instructions.

In the case of a contract with insurance, an additional monthly fee will be added, which is 8% of your loan instalment (principal + interest). For example, if you take out a loan in the amount of EUR 500 for two years, only about EUR 2 will be added to your monthly instalment.

Customer support

Call 699 9119 Mon-Fri 9–17 or write to finance@lhv.ee