LHV Pensionifond S

Suitable if

- you have 2–5 years left until retirement age,

- you have low risk tolerance,

- your aim is the preservation and modest growth of your pension savings.

A responsible keeper in S

- We invest the assets of the S fund mainly in bonds. The fund’s assets may also be invested in bonds with a credit rating below investment grade.

- Up to 25% of the fund’s assets may be invested in real estate, items of infrastructure, equity funds and convertible bonds.

- The fund can also be used to grant loans. The fund’s preferred long-term asset class is listed debt instruments.

Romet Enok

Fund Manager at LHV

„Money in seriously large amounts moves in the world in the form of bonds. In truth, a bond is nothing more than a fancy name for a loan contract: parties agree on the time when the money is disbursed, the interest rate, and the repayment.“

Biggest investments

The data is presented as at 30.11.2024

| Biggest investments | |

|---|---|

| Eesti Energia perpetual NC5.25 | 7.54% |

| Luminor 7.75% 08/06/2027 | 5.99% |

| German Treasury Bill 19/03/2025 | 5.67% |

| France Treasury Bill 09/04/2025 | 5.66% |

| ALTUMG 1.3% 07/03/25 | 5.17% |

| ZKB Gold ETF | 4.98% |

| KBC Group NV 0.625% 07/12/2031 | 4.02% |

| Kojamo 0.875% 28/05/2029 | 3.96% |

| German Treasury Bill 11/12/2024 | 3.81% |

| BNP Paribas 2.5% 31/03/2032 | 3.79% |

Biggest investments in Estonia

| Biggest investments in Estonia | |

|---|---|

| Eesti Energia perpetual NC5.25 | 7.54% |

| Luminor 7.75% 08/06/2027 | 5.99% |

| Coop Pank 5.0% 10/03/2032 | 3.31% |

Asset Classes

Information about the fund

| Information about the fund | |

|---|---|

| Volume of the fund (as of 30.11.2024) | 26,257,438 € |

| Management company | LHV Varahaldus |

| Equity in the fund | 90,000 units |

| Rate of the depository’s charge | 0.0439% (paid by LHV) |

| Depository | AS SEB Pank |

Entry fee: 0%

Exit fee: 0%

Management fee: 0,6120%

Success fee: no commission

Ongoing charges (inc management fee): 0,68%

Ongoing charges are based on expenses for the last calendar year, ie 2023. Ongoing charges may vary from year to year.

Terms and Conditions

Prospectus

November 2024: We increased the volume of our direct investment portfolio

Kristo Oidermaa and Romet Enok, Fund Manager

Last month, we expanded our direct investment portfolio by entering into a loan agreement with Eastnine, a real estate company primarily focused on the Lithuanian and Polish markets. The loan has a three-year term, and the pension fund earns an annual interest rate of 8.5%. At the same time, Eastnine also raised new equity and secured bank loans, continuing its growth plans in the Polish commercial real estate market. Having previously held investments in Estonia, the company has now set its sights mainly on the Polish market, where assets now make up the majority of its portfolio following this major transaction.

In November, EfTEN Real Estate Fund 5, in partnership with six Estonian entrepreneurs, announced the acquisition of Tallinn’s Kristiine shopping centre, valued at €123.5 million. This marks the fund’s final investment. The centre spans 61,600 sq. m and houses 120 tenants, with the largest being Prisma and Apollo. The acquisition is financed through a combination of equity and a syndicated loan from SEB and Swedbank.

October 2024: We sold two significant bond positions in October

Kristo Oidermaa and Romet Enok, Fund Manager

In October, we sold two significant bond positions – Volkswagen and Riigi Kinnisvara AS. Bond prices on international markets have risen significantly, especially for corporate bonds. We acquired a large volume of listed bonds in the autumn of 2022, when markets were in turmoil over rising interest rates. With prices now recovering, we are gradually reducing these positions.

We also sold about a third of one of the fund’s largest investments – gold. The funds generated are being redirected into short-term German and French government bonds. For new investments, our most likely next step will be acquiring an over-the-counter direct investment.

September 2024: Bonds continued to rise

Kristo Oidermaa and Romet Enok, Fund Manager

September was another successful month for the fund’s two major investments – Eesti Energia bonds and gold. In broader terms, the expectation that the European Central Bank will continue to cut interest rates (which means an increase in bond prices) is so widely held in the market right now that it is extremely difficult to find attractive new investment opportunities. Rather, the next likely change in the portfolio is a sale of securities.

August 2024: Eesti Energia bonds have started with strong results

Kristo Oidermaa and Romet Enok, Fund Manager

Our major investment this summer – Eesti Energia subordinated bonds – has started with strong results, bringing the fund a return of approximately 3% by the end of August. A significant part of this return was due to the overall decline in interest rates in Europe (reminder: when interest rates are lowered, the prices of most bonds rise automatically). If the company’s results improve, the price of the bonds could increase further. To top it off, the fund accumulates interest at the rate of 7.875% per year in the meantime.

July 2024: We made a new major investment

Kristo Oidermaa and Romet Enok, Fund Manager

The fund has recently made a significant new investment by subscribing to Eesti Energia’s new bonds. These bonds offer an annual interest rate of 7.875%, and Eesti Energia will likely repay the loan in approximately five years. In addition to bank loans, the energy provider raised funds through bonds to complete its extensive investment plan. Capital-intensive construction projects are underway in the renewable energy, network services and fuel business sectors.

To balance this, we decided to reduce the fund’s exposure by selling Glencore’s long-term bonds. Glencore, a Swiss-based global commodities broker, was one of our notable investments made during the bond market turmoil in the fall of 2022. Now that the markets have recovered, we prefer to reduce risks and increase the cash level of the fund.

In addition to pulling back from the international bond market, the fund’s cash reserves were further increased by the local real estate fund, Baltic Horizon. The company repaid the shorter part of the bond they issued in the spring of last year.

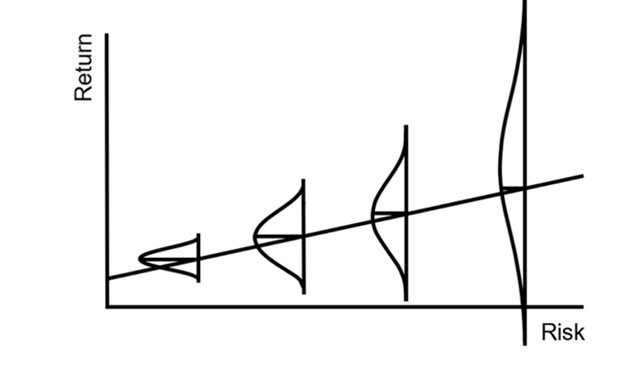

Is maximum risk the optimal strategy?

Andres Viisemann, Head of LHV Pension Funds

October was a relatively calm month in the securities markets. On 17 October, the European Central Bank lowered its short-term interest rates by 0.25 percentage points. Since the decision was widely anticipated and already priced into stock markets, it elicited little reaction from participants.