Comparison: money from II pillar or a loan

Do you wish to compare what would be more useful: to cover existing loans and important expenses at the expense of Pillar II, or to borrow money from a bank for this purpose? Use the pension money calculator.

Results

| II pillar | |

| If you continue saving, the amount you would have in the second pillar when you retire is | 0 € |

| If you withdraw the money, then | |

| the amount you will not contribute to the second pillar in 10 years is | 0 € |

| the amount the state will not contribute to the second pillar is | 0 € |

| the amount of lost return after 10 years is | 0 € |

| the amount of income tax you will immediately pay on second pillar funds is | 0 € |

| Loan / lease | |

| Monthly repayment | 0 € |

| Total interest paid to the bank | 0 € |

| Summary | |

| The impact on your wallet over the next 10 years of withdrawing money from the II pillar | 0 € |

| This is equal to you lending the amount on your second pillar account from the bank for: | |

| 10 years at an annual interest rate of | 0 € |

| 5 years at an annual interest rate of | 0 € |

| 3 years at an annual interest rate of | 0 € |

| 1 years at an annual interest rate of | 0 € |

- Calculations made using the calculator are based on the long-term salary growth forecast of the Ministry of Finance (4% per annum). The age of retirement is assumed to be 65.

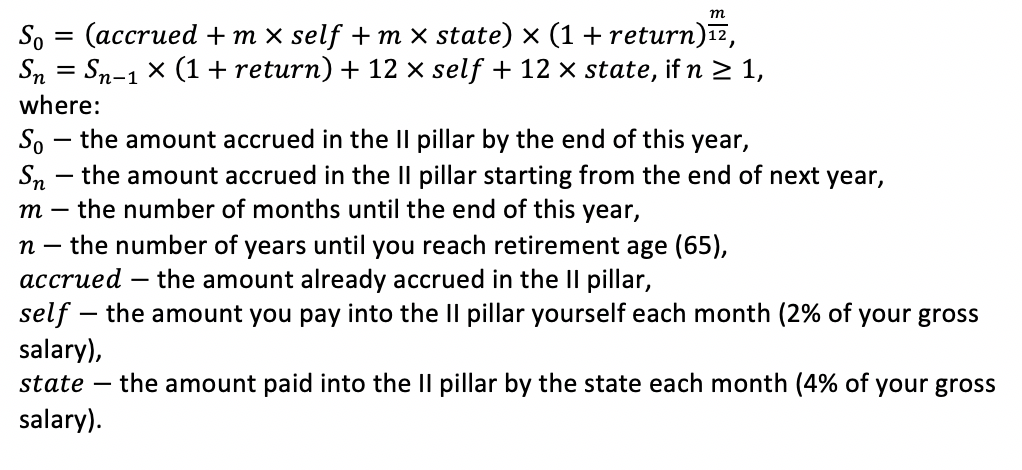

- The amount accrued in the II pillar at the moment of retirement is found using the following formula:

- The amount lost/gained over 10 years in withdrawing money from the II pillar = 2% gained monthly from your salary over the next 10 years (minus income tax) – income tax payable immediately upon withdrawing money from the II pillar – 4% not paid into the II pillar by the state over the next 10 years – return potentially not gained.

The calculator's calculations are based on the data entered the calculator by the user. The rate of return of the entered pension fund fluctuate over time and its value may rise or fall. It must be taken into consideration that higher rates of return are accompanied by greater risks and a previous rate of return is not a guarantee of the same rate of return in the future.